- 516 Update

- Posts

- Your Guide to Nassau County Property Taxes

Your Guide to Nassau County Property Taxes

Getting your Nassau County property tax bill can feel a little daunting. For most of us homeowners, it's one of the biggest checks we write all year, but the calculation behind that final number can seem like a total mystery. This guide is here to pull back the curtain, replace that confusion with confidence, and put you in the driver's seat.

Cracking the Code of Your Nassau County Tax Bill

If looking at your tax bill feels like trying to solve a complex puzzle, you're in good company. Many residents get lost in the jargon and line items, wondering where all that money actually goes. The short answer? It's the engine that runs our community.

Think of the total tax collected across the county as one big community fund. Every dollar is a slice of that fund, dedicated to an essential service that makes Long Island a great place to live.

So, Why Are Nassau County Taxes So High?

Let's be direct: Nassau County has some of the highest property taxes in the entire country. A huge reason for this is that our taxes directly fund our top-tier public schools—they take the biggest piece of the tax pie. But it doesn't stop there. Your tax dollars are also hard at work keeping our neighborhoods safe, clean, and running smoothly.

This funding supports:

Emergency Services: Police departments, fire districts, and ambulance services that are there when you need them most.

Public Works: The crews that maintain our roads, parks, and libraries, plus the sanitation services that keep our streets clean.

Local Government: The administrative side of things, making sure town and county operations run efficiently.

To put it in perspective, let's look at some key numbers.

Nassau County Property Tax at a Glance

This table breaks down how our local property tax metrics stack up against the rest of the country. It really highlights the unique financial landscape we navigate as homeowners here.

Metric | Nassau County | National Average |

|---|---|---|

Median Effective Property Tax Rate | 2.10% | 1.02% |

Median Annual Property Tax Payment | $14,872 | $2,795 |

Median Home Value | $605,300 | $281,900 |

As you can see, the numbers are starkly different. While it's a significant expense, understanding the "why" behind it is crucial.

Ultimately, your property tax is a direct investment in our community. From the schools our kids attend to the parks where we relax, your payment funds the shared resources that maintain our quality of life.

Building Your Foundational Knowledge

To really get a handle on your bill, you need to understand a few key terms that form the bedrock of the system. We'll break down concepts like property assessment, tax rates, and levies using simple, everyday analogies.

Getting these fundamentals down is the first step. From there, you can read your bill with clarity, spot potential savings, and navigate the system like a pro. To get a better sense of the market forces affecting property values, you can explore our complete guide to Nassau County real estate.

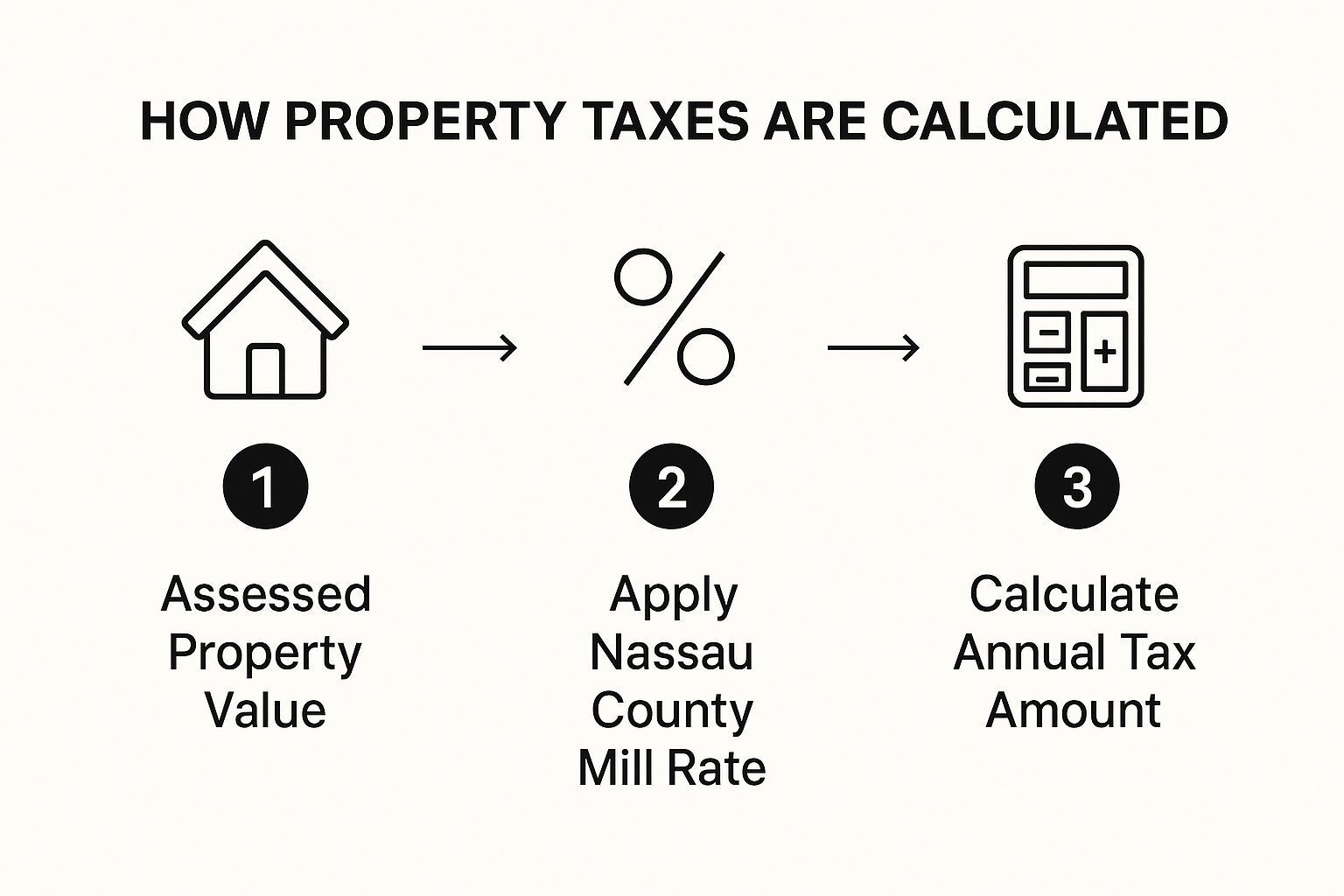

How Your Property Tax Is Actually Calculated

Let's pull back the curtain on the math behind that number on your tax bill. It might seem like they pull it out of thin air, but there's a specific formula at work across Nassau County. Getting a handle on this calculation is your first step to making sure everything is accurate and finding any potential reasons to challenge it.

The whole process boils down to two key terms that people often mix up: Market Value and Assessed Value. They sound alike, but they play very different roles when it's time to calculate your taxes.

Market Value Versus Assessed Value

Think of your home's Market Value as its Zillow Zestimate or what a real estate agent would tell you it could sell for on a good day. It’s what your property might fetch in a competitive market, and this number can go up and down with housing trends.

But the county doesn't tax you on that number directly. Instead, they come up with an Assessed Value, which is a small fraction of the Market Value created strictly for tax purposes. For residential properties here in Nassau, that fraction is a tiny 0.10% of the market value.

This is the most important part to remember: Your taxes are not based on what your house could sell for. They're calculated on a small sliver of that value, a figure designed specifically for the tax system.

This approach is meant to bring some stability to the process, so your tax bill doesn't skyrocket just because the real estate market is having a hot year.

Understanding Nassau County's Class System

There's one more layer to this. Nassau County sorts every property into one of four classes, a system that mirrors New York City's. It's a way to group similar properties together to make sure tax rates are applied as fairly as possible. If you own a 1-3 family home, you're almost certainly in Class 1.

Here’s the basic breakdown:

Class 1: This is for most residential properties, like single-family homes, duplexes, etc.

Class 2: Covers other residential spots, mainly apartments, condos, and co-ops.

Class 3: This class is just for utility company properties.

Class 4: Lumps together all commercial and industrial properties.

Your property's class is a big deal because it directly influences the tax rates you'll pay. For anyone curious about how these tax rates stack up against other parts of the state, the New York State Department of Taxation and Finance has some interesting data you can look through.

The Calculation Formula in Action

Alright, let's put all the pieces together. Imagine you own a home in Nassau County, and the county has pegged its market value at $700,000.

This simple graphic shows how we get from that big number to your final tax bill.

It’s really a three-step journey from your home's value to the tax you owe.

Let’s run the numbers from our example:

Find the Assessed Value: The county takes your Market Value and multiplies it by the residential assessment ratio.

$700,000 (Market Value) x 0.10% (Assessment Ratio) = $700 (Assessed Value)

Apply Tax Rates (Levies): Next, that small Assessed Value gets hit with the tax rates for your town, school district, and the county itself. These rates, called levies, vary quite a bit from one community to the next.

Let's pretend the combined tax rate for your area is $160 for every $10 of assessed value.

Calculate the Final Bill: The last step is just a bit of multiplication.

($700 / $10) x $160 = 70 x $160 = $11,200 (Annual Property Tax)

That $11,200 is your total yearly property tax bill before any exemptions are factored in. Now that you see how the sausage is made, you can look at your own tax statement and know exactly what each number means. It’s the key to making sure you’re being assessed fairly.

Finding Savings with Key Tax Exemptions

Knowing how your tax bill is calculated is one thing, but finding ways to shrink it is the real goal. Thankfully, Nassau County property taxes aren't a fixed, unchangeable expense. Tax exemptions are the single most powerful tool you have to lower your annual bill.

Think of them as targeted discounts that subtract a chunk of your home's assessed value before the tax math even begins. It’s like using a high-value coupon at the checkout counter—you don’t get cash back, but the discount comes right off the top. Each exemption you qualify for can lead to tangible savings, sometimes adding up to thousands of dollars every year.

These programs are designed to provide real relief, but here's the catch: they are not automatic. You have to apply for them. Many homeowners miss out simply because they don't realize what's available or get intimidated by the paperwork. Let's break down exactly what you should be looking for.

The STAR Program: The Cornerstone of School Tax Relief

If you want to make a big dent in your tax bill, start here. The School Tax Relief (STAR) program is the most widely known exemption in New York State for a good reason—it directly targets school taxes, which make up the biggest piece of the pie.

STAR isn't a one-size-fits-all deal. It's broken into two main tiers based on your age and income.

Basic STAR: This is for homeowners whose primary residence is in Nassau County and whose federal adjusted gross income is $500,000 or less. For most newer homeowners, this benefit now arrives as a check directly from the state instead of a deduction on the tax bill.

Enhanced STAR: This is the supercharged version for senior citizens, offering a much larger exemption. To qualify, you must be 65 or older (or a surviving spouse who meets the criteria) and fall under a specific income limit that changes annually. The savings can easily be more than double the Basic STAR benefit.

Securing these exemptions means being proactive. Juggling the forms and deadlines for multiple programs can feel overwhelming, which is why many residents turn to the best tax preparation services in Nassau County to make sure everything is filed correctly.

Vital Exemptions Beyond STAR

While STAR gets most of the attention, several other crucial exemptions can provide relief to specific groups. The best part? You can often stack these with STAR to maximize your savings on your total Nassau County property taxes.

Remember, each exemption has its own specific eligibility rules and application process. It’s absolutely essential to check the guidelines for each one to confirm you qualify before you apply.

Senior Citizen and Persons with Disabilities Exemptions

In addition to Enhanced STAR, there are other powerful programs for seniors and individuals with disabilities who are on a limited income.

Senior Citizens’ Exemption: This can be a game-changer, potentially cutting the assessed value of your home by up to 50%. The exact reduction depends on your income and applies to county, town, and school taxes. You must be 65 or older and meet a sliding income scale.

Persons with Disabilities and Limited Incomes Exemption: This works very similarly to the senior exemption. It offers a property tax reduction of up to 50% for individuals with a documented disability who meet certain income thresholds.

Honoring Service with Veterans Exemptions

Nassau County proudly offers several property tax exemptions to thank our military veterans for their service. The specific benefits depend on when and where a veteran served.

Key programs include:

Alternative Veterans' Exemption: Available to veterans who served during a designated period of war, providing a valuable reduction in assessed value for county and town taxes.

Cold War Veterans' Exemption: Offers a property tax break specifically for veterans who served during the Cold War era.

Eligible Funds Exemption: This exemption reduces your home's assessed value based on the amount of eligible funds (like pensions or bonus pay) used to purchase the property.

Taking the time to understand and apply for these exemptions is the most direct way to get a handle on your property tax bill. By claiming every benefit you're entitled to, you can significantly reduce one of your biggest yearly expenses and keep more of your money where it belongs—with you.

Think Your Property Assessment is Unfair? Here’s What to Do.

If you’ve ever opened your annual assessment notice and thought, “This number just can’t be right,” you’re not alone. It's a common feeling for homeowners across Nassau County. But here's the good news: you have the right to fight back. Challenging your property assessment, a process officially known as filing a tax grievance, is your most powerful tool for making sure you're not overpaying.

This isn't some secret loophole; it's a standard procedure that thousands of your neighbors use every single year. And failing to do so when your assessment is too high can cost you. A lot. An eye-opening investigative report by Newsday found that over seven years, a staggering $1.7 billion in tax liabilities shifted from homeowners who successfully grieved their taxes to those who didn’t. You can dig into the full investigation on the Lincoln Institute of Land Policy website.

The takeaway here is critical: successfully appealing your assessment doesn't just lower your bill—it stops you from picking up the tab for others.

Do You Have a Valid Case?

You can’t appeal just because your taxes feel too high. To get the county’s attention, you need to build a solid case based on specific legal grounds. The Nassau County Assessment Review Commission (ARC) will only consider grievances that fall into one of these four buckets:

Unequal Assessment: This is the big one for most homeowners. It means your property is assessed at a higher percentage of its market value than other properties in your area. It's the most common—and often most successful—basis for a residential appeal.

Excessive Assessment: This happens for a few reasons. The county might value your home for more than its actual market value, or perhaps you were incorrectly denied an exemption you qualify for.

Unlawful Assessment: This is more clear-cut. It applies if the assessment was made against a property that's completely tax-exempt (like a church) or if there was a simple clerical error on the tax roll.

Misclassification: This is rare for homeowners but happens. It means your property was put in the wrong category, for instance, your home was mistakenly classified as a commercial building.

For nearly everyone reading this, the argument will boil down to an unequal or excessive assessment, and you'll prove it by comparing your home to similar ones nearby.

Building Your Case, Step by Step

Challenging your assessment is a bit like being a detective. Your job is to gather the right clues to prove your home's valuation is off the mark.

Scrutinize Your Assessment Notice: When you get your Notice of Tentative Assessed Value (usually in early January), go over it with a fine-tooth comb. Are the details about your property—lot size, square footage, number of bathrooms—100% accurate? Any mistake here is an easy place to start.

Gather Your Evidence (The "Comps"): This is where you win or lose your case. You need to find "comparable sales," or "comps." These are recent sales of homes that are very similar to yours in size, style, condition, and location. The goal is to find several examples showing that homes like yours sold for less than the county's assessed value of your property.

Fill Out the Grievance Application: You must file the official "Application for Correction of Assessment" with the ARC. This is your formal request. Be thorough and precise—an incomplete application can be tossed out on a technicality.

File on Time: Nassau County has a non-negotiable filing deadline, usually in early March. If you miss this date, you lose your right to appeal for the entire year. No exceptions.

The strength of your grievance rests entirely on the quality of your evidence. The better your comparable sales data, the higher your chance of a successful appeal.

What Happens After You File?

Once your application is in, the ARC begins its review. Be patient, as this process can take several months. Eventually, you’ll receive a written decision in the mail. If you win, you’ll see a reduction in your property's assessed value, which means a lower tax bill going forward.

But what if the ARC denies your grievance, or the reduction isn't what you hoped for? You’re not out of options. The next step is filing a Small Claims Assessment Review (SCAR) petition. This is a slightly more formal but still very homeowner-friendly process where your case is heard by an impartial hearing officer. It’s your second chance to prove your home is over-assessed and get the fair valuation you deserve.

Your Annual Tax Calendar and Payment Guide

When it comes to Nassau County property taxes, timing is everything. Missing a deadline isn't just an inconvenience; it can hit you with some pretty hefty penalties and interest charges that can quickly inflate your bill.

The best way to stay ahead is to think of the property tax year as a predictable cycle. Once you understand the rhythm of when notices are sent and when payments are due, you can plan accordingly and avoid any last-minute stress. This guide breaks down that entire timeline for you, so there are no surprises.

Nassau County Annual Property Tax Calendar

The tax year in Nassau County can feel a little confusing because it’s split into two main bills: school taxes and general taxes. Each has its own schedule, so keeping track of both is essential. Think of this calendar as your cheat sheet for staying on top of every important deadline.

Here’s a look at the key dates and what you need to do at each stage.

Date/Period | Event | What You Need to Do |

|---|---|---|

Early January | Notice of Tentative Assessed Value Arrives | Keep an eye on your mailbox for this notice. It's your first look at what the county thinks your home is worth for the next tax year. Review it closely. |

Jan 2 - Mar 1 | Grievance Filing Period | If the assessed value looks too high, this is your official window to challenge it. You must file your appeal with the Assessment Review Commission (ARC) by March 1st. |

October 1 | First-Half School Tax Bill Mailed | Your first major bill of the cycle will arrive. You have until November 10th to pay this first installment without any penalties. |

April 1 | First-Half General Tax Bill Mailed | The second major bill, for general taxes (which fund county and town services), is sent out. This payment is due by May 10th. |

This timeline repeats every year, making it a reliable guide for your financial planning. Knowing these dates helps you anticipate expenses and ensures you have the funds ready when it's time to pay.

How To Pay Your Property Taxes

Nassau County makes it fairly straightforward to pay your bill, offering a few different options to fit your preference. One key thing to remember is that you don't pay the county directly; your payments go to the Town Receiver of Taxes where your property is located (e.g., Town of Hempstead, Town of Oyster Bay).

Here are the most common ways to pay:

Online: Most towns have secure online payment portals. You can usually pay with a credit card (which often includes a convenience fee) or an e-check directly from your bank account.

By Mail: The classic method. Just mail a check or money order to your Town Receiver of Taxes. The most important thing here is the postmark—make sure it’s on or before the due date to avoid being marked as late.

In-Person: If you prefer handling things face-to-face, you can always visit your local Town Receiver's office and pay your bill directly.

A word of caution: falling behind has an immediate financial cost. A 1% penalty is tacked on for each month your payment is late. Staying on top of these deadlines is the simplest and most effective way to keep your tax bill from growing.

The county's own financial decisions, of course, play a huge role in what you owe. For a closer look at how local government is managing its finances, you can read about the latest budget, which discusses the effort to keep Nassau County taxes flat. Keeping this annual calendar handy is your best defense against surprises and penalties.

Proactive Tips for Managing Your Tax Bill

Getting your Nassau County property taxes lowered through an appeal or exemption feels great, but staying on top of your tax bill is an ongoing effort. The best strategy is to be proactive throughout the year, not just reactive when the bill shows up.

This proactive mindset starts the day your annual assessment notice arrives. Don't just give it a quick look and toss it in a drawer. Go over it with a fine-tooth comb. Check every single detail—the square footage, your property class, everything. You'd be surprised how often a simple clerical error can lead to a much bigger problem if it isn't caught early.

Make Budgeting Automatic with an Escrow Account

One of the smartest ways to handle this major household expense is to make it painless. For many homeowners, that means setting up an escrow account to roll their property taxes right into their monthly mortgage payment.

Think of it as a forced savings account just for your property taxes and homeowner's insurance. It works beautifully:

No More Giant Bills: Instead of getting hit with two massive tax payments a year, you contribute a small, manageable amount every month.

Set It and Forget It: Your mortgage company takes care of everything—collecting the funds, holding them safely, and making sure your tax bills are paid on time.

Total Peace of Mind: This approach eliminates the stress of saving up for a huge payment and removes any worry about accidentally missing a deadline.

An escrow account smooths out a lumpy annual expense into twelve predictable payments, making your Nassau County property taxes feel like just another part of your regular budget.

Plan Home Improvements with Taxes in Mind

We all love upgrading our homes. A new kitchen or a finished basement can add real value and improve your life. But it's important to remember that significant renovations can also catch the eye of the tax assessor.

Major projects that add to your home's footprint—like a new bedroom, a bathroom addition, or a second-story dormer—are almost guaranteed to increase your assessed value. On the other hand, cosmetic updates like fresh paint, new countertops, or refinished floors usually fly under the radar.

This doesn't mean you should put off valuable improvements. It just means you should go into them with your eyes open. If you're planning a major addition, it’s wise to budget for a potential tax increase down the line. By understanding how different projects affect your assessment, you can make smart decisions that balance your home improvement dreams with your long-term financial plan, ensuring there are no unpleasant surprises come tax time.

Common Questions About Nassau County Taxes

Let's face it, digging through dense government websites to understand your property tax bill is nobody's idea of a good time. That's why we've put together answers to the questions we hear most often from Nassau County homeowners.

Think of this as your quick-reference guide. We’ve tackled the big questions to help you make sense of your bill, find potential savings, and feel more in control of your tax obligations.

Why Are My Nassau County Property Taxes So High?

This is the million-dollar question, isn't it? The short answer is that our property taxes are the lifeblood for top-tier local services, especially our public schools, which receive the largest chunk of the funding.

High property values across the county are another major factor. When you combine those values with the cost of running excellent police and fire departments, libraries, and parks, you get a tax rate that's more than double the national average. Your bill directly reflects the community's deep investment in these shared resources.

In essence, those high tax bills are the price of admission for the premium services and sought-after school districts that are a hallmark of life in Nassau County.

What Is the Difference Between Basic STAR and Enhanced STAR?

Both STAR programs are fantastic ways to get a break on your school tax bill, but they're aimed at different groups of homeowners.

Basic STAR: This is for homeowners who meet a certain income limit. It provides a helpful exemption that lowers the taxable value of your home, reducing your school tax payment.

Enhanced STAR: This is a more generous version specifically for senior citizens. You have to be 65 or older and meet a different (and lower) income threshold to qualify.

One critical detail: these benefits aren't automatic. You have to apply for the program you're eligible for to see those savings on your Nassau County property taxes.

Can I Still File a Grievance If I Miss the Deadline?

Unfortunately, no. The grievance filing deadline in Nassau County—usually around March 1st—is a hard stop. If you let that date pass, you've missed your chance to challenge your property's assessment for the entire tax year.

This is exactly why it’s so important to open and review your Notice of Tentative Assessed Value as soon as it shows up in January. If the number looks wrong, you need to move fast to get your grievance application in before that window slams shut. If you miss it, you’ll have to wait for next year's assessment cycle to try again.

How Do I Find Sales Data for My Tax Appeal?

To win a tax grievance, you need proof. The best proof comes from "comps"—recent sales of homes that are very similar to yours in location, size, and style.

Here are a few ways to track down this crucial evidence:

Public Records: The Nassau County Land Records Viewer is a free public tool where you can search for property sales data.

Real Estate Professionals: A local real estate agent can run a comparative market analysis (CMA) for you, which is a professional report of recent sales in your immediate area.

Professional Services: Many homeowners hire a professional tax grievance company. These experts live and breathe this kind of research and can manage the whole appeal process from start to finish.

Presenting solid, recent sales data is the most powerful way to prove your home is over-assessed and build a convincing case for a reduction.

For the latest on local news, events, and community updates that matter to you, stay connected with 516 Update. We are your go-to source for everything happening in Nassau County. Find out more at https://516update.com.