- 516 Update

- Posts

- Long Island Median Income Explained

Long Island Median Income Explained

When you look at the numbers, it's clear Long Island is an economic powerhouse. Nassau County households pull in a median income of around $137,000, while in Suffolk County, that figure is about $122,000. These aren't just high; they're significantly above what you see across the rest of the country, painting a picture of a prosperous region.

What Is the Median Income on Long Island

Before we dive deeper, let's get on the same page about what Long Island median income actually means. It’s a simple but powerful concept.

Imagine you could line up every household on Long Island in a single file, from the one earning the least to the one earning the most. The median income is the income of the household standing smack-dab in the middle of that line. Fifty percent of households earn more, and fifty percent earn less.

This is a much more realistic way to gauge what life is like for the typical family here compared to using the "average" income. Why? Because averages can be misleading. If a handful of billionaires moved into a town, their astronomical incomes would drag the average way up, making it seem like everyone is rolling in cash. The median, on the other hand, isn't thrown off by those outliers at the very top or bottom.

Median income gives us a grounded, real-world benchmark. It cuts through the noise and tells us what the representative household is actually bringing home, which is the only way to have a meaningful conversation about affordability and the cost of living.

Why This Figure Matters

So, why do we focus so much on this one number? Because the median income is far more than just a statistic; it’s a practical yardstick for measuring the financial realities of an area.

Here’s what makes it so important:

A Realistic Benchmark: It gives us a clear sense of the earning power of the typical resident, acting as a reliable pulse check on the local economy's health.

An Affordability Gauge: When you stack the median income up against local housing prices, property taxes, and grocery bills, you get a true picture of how financially comfortable—or stretched—the average family might be.

A Tool for Planning: Local governments, school districts, and urban planners lean on this data to make crucial decisions about everything from affordable housing initiatives to public transit and new business development.

With this foundation, we can now dig into the specifics for Nassau and Suffolk.

To put these numbers in perspective, here's a quick side-by-side look at how Long Island's counties stack up.

Long Island Median Household Income At a Glance

This table provides a snapshot of the median household income for Nassau and Suffolk counties, comparing them against New York State and the entire United States.

Region | Median Household Income |

|---|---|

Nassau County, NY | $136,991 |

Suffolk County, NY | $122,839 |

New York State | $79,557 |

United States | $74,580 |

As you can see, both counties boast incomes that are substantially higher than both the state and national figures, underscoring the area's economic standing.

Why Median Income is the Number to Watch

To really get a handle on Long Island's economy, we have to look past simple averages. The number that truly tells the story is the Long Island median income—it gives us a much clearer picture of what a typical family actually brings home.

Here’s a simple way to think about it. Imagine a small company with nine employees who each make between $50,000 and $70,000 a year. Then there's the CEO, who pulls in $2 million. If you calculate the average salary, that massive CEO paycheck would drag the number way up, making it look like everyone is earning a fortune. It’s misleading.

The median income, however, cuts through that distortion. To find it, you'd line up all ten salaries from lowest to highest and pinpoint the one smack-dab in the middle. That middle number would land somewhere in that $50,000-$70,000 range, offering a far more realistic snapshot of a typical employee's earnings. The median isn't swayed by that one outlier at the top.

The Real Story of Financial Health

This is exactly why economists and policymakers lean so heavily on median income. It's the most reliable benchmark we have for judging the financial well-being of a community.

By zeroing in on the midpoint, median income reflects the economic reality for the everyday resident, not some skewed figure inflated by the wealthiest households. It’s simply a more honest gauge of prosperity.

This single statistic is powerful because it helps us answer the tough questions about what it really costs to live here. When we stack the median income up against local expenses, we start to see the financial pressures Long Island families are really up against.

For example, this number is crucial for figuring out:

Housing Affordability: Can a family earning the median income realistically afford a mortgage or rent in the town they want to live in?

Tax Burdens: How much of a typical household's paycheck is eaten up by things like property taxes? It's impossible to grasp the true weight of Nassau County property taxes, for instance, without a solid income benchmark.

Economic Trends: Is the standard of living actually improving for most people, or is wage growth just treading water? Tracking median income over time shows us the real direction things are heading.

Bottom line: understanding median income is the first step. It grounds all the other data in reality and helps us see what these big numbers mean for the everyday lives of families all across Long Island.

A Tale of Two Counties: Nassau vs. Suffolk

Anyone from around here knows that even though we talk about "Long Island" as one place, it’s really a tale of two counties. Nassau and Suffolk sit right next to each other, but when you look at their economies, they tell two very different stories. Their median incomes are shaped by everything from geography and history to the kinds of industries that have put down roots.

Nassau County, being just a stone's throw from New York City, has always been a magnet for high-earning professionals who commute into Manhattan. Its economy is tightly woven into the city's financial and corporate worlds, which means a higher density of executive-level jobs and well-established professional services. That direct pipeline to the city has created a landscape of mature, densely packed suburbs and thriving commercial centers.

Head east, and things start to change. Suffolk County is a sprawling, diverse mix of classic suburban towns, the famous farms and vineyards of the East End, and world-class research hubs. Its economic engine is much more varied, powered by healthcare, technology, and major players like Stony Brook University and Brookhaven National Laboratory.

The Numbers Tell the Story

These different economic personalities show up clearly in the Long Island median income data. The 2023 numbers reveal a noticeable gap between the two, painting a picture of their unique financial makeups.

Suffolk County clocked in with a median household income of $113,683. That’s an impressive number by any standard.

But Nassau County soared even higher, reaching approximately $125,696. This figure cements its reputation as one of the absolute wealthiest counties in the entire country.

This income gap isn’t just a statistic on a spreadsheet. It reflects fundamental differences in the job markets, the cost of housing, and the day-to-day lifestyles in each county. Nassau's higher figure is fueled by its deep ties to corporate and financial power, while Suffolk's strength comes from a wider, more diversified economic foundation.

Nassau vs Suffolk County Economic Snapshot

Here’s a comparative look at the key economic indicators for Long Island's two main counties. This table helps visualize the distinct financial profiles we've been discussing.

Indicator | Nassau County | Suffolk County |

|---|---|---|

Median Household Income | $125,696 | $113,683 |

Primary Economic Drivers | Finance, Law, Corporate HQ | Healthcare, Tech, Research |

Proximity to NYC | Closer | Farther |

Real Estate Market | Higher Cost, Densely Populated | More Varied, Sprawling |

As you can see, while both counties are affluent, the numbers point to Nassau's slightly stronger position in terms of pure income, largely driven by its location and industry focus.

What Drives the Difference?

So, why the gap? It’s more than just being closer to the city. Several key ingredients give Nassau and Suffolk their unique economic flavors.

Industry Focus: Nassau's job market is heavily concentrated in finance, law, and corporate management. While Suffolk has its share of professional services, it boasts major hubs for scientific research, engineering, and even agriculture.

The Real Estate Factor: Housing costs play a massive role. Higher demand and less available space in Nassau naturally drive up property values. To get a better sense of this dynamic, check out our deep dive into the Nassau County real estate market.

Commuting and Geography: It's a simple fact of geography. Nassau’s layout and location make for a more straightforward commute into the five boroughs, making it the top choice for many high-powered professionals working in Manhattan.

At the end of the day, both counties are economic juggernauts, but they get there on different paths. Nassau’s power comes from its established wealth and connection to the city's financial heart. Suffolk’s is built on a diverse mix of industries and forward-thinking innovation. Understanding this "tale of two counties" is crucial to seeing the full financial picture of Long Island.

How Long Island's Income Has Evolved Over Time

The impressive salaries we see on Long Island today didn't just appear overnight. They're the result of a decades-long story of economic transformation that has cemented the island's reputation for prosperity. To really get a handle on the current Long Island median income, it helps to look back at how we got here.

It all started with the post-war suburban boom. This was the era that really shaped modern Long Island, turning vast stretches of farmland into the sprawling residential communities we know today. This shift attracted countless families from the city and laid the groundwork for a completely new economic base.

From Suburban Boom to Economic Powerhouse

Long Island's economy didn't just stop there. After that initial explosion of growth, it continued to evolve, attracting high-paying industries that really pushed incomes to the next level.

Several key sectors were responsible for this incredible wage growth:

Aerospace and Defense: For a huge part of the 20th century, companies like Grumman were the lifeblood of the local economy, offering thousands of stable, well-paying jobs.

Technology and Research: Later, the rise of major research centers created a new wave of high-tech opportunities, pulling in top talent from all over.

Healthcare and Education: As the island's population swelled, so did the demand for top-tier hospitals and schools, which have become some of the area's largest employers.

These waves of economic development built upon one another, creating the foundation for the high median incomes residents enjoy today. It's a story of consistent, powerful growth.

The narrative of Long Island's income is one of steady upward momentum. Each decade has added a new layer of economic strength, pushing the median income higher and higher.

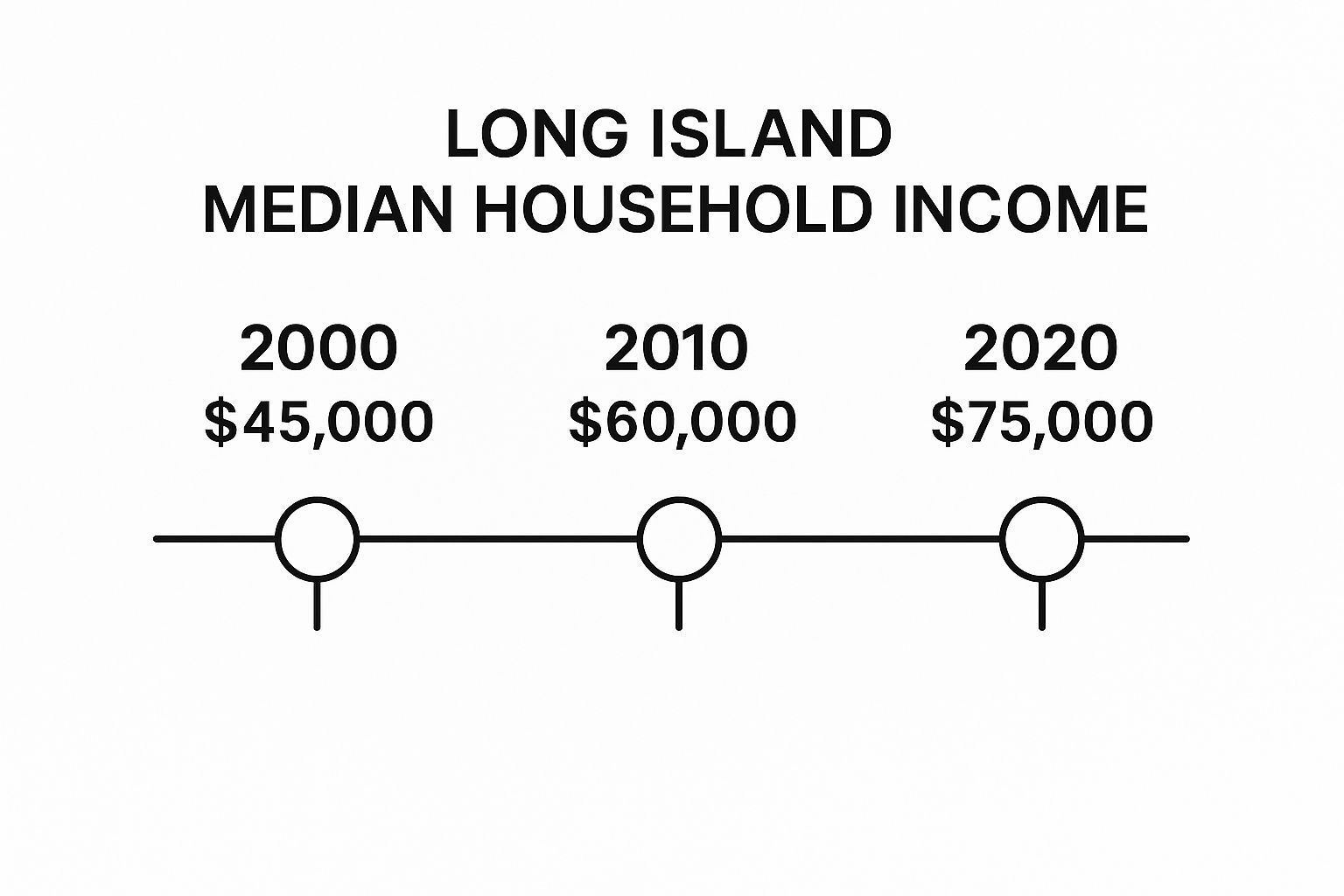

This timeline gives you a great visual of just how much Long Island's median household income grew between 2000 and 2020.

As you can see, it's a clear and powerful upward trend, one that reflects the region's enduring economic strength. This momentum hasn't slowed down, either, with incomes hitting new highs and reinforcing the island's status as an affluent area.

This isn't just ancient history. According to recent federal data for Suffolk County, the median household income reached a record $123,219 in January 2023. That’s a massive leap from the $43,339 reported back in January 1989—a nearly threefold increase that really underscores the area's sustained economic power over the last thirty years. You can explore more about these historical income trends and what they tell us about the local economy.

The Link Between Income and Cost of Living

A high Long Island median income certainly suggests prosperity, but that number only tells you half the story. The other, equally crucial half is the region’s notoriously high cost of living, which creates a tough financial reality for almost everyone who lives here. It’s not about what you earn; it’s about what you have left after all the bills are paid.

This tug-of-war between income and expenses is where the real affordability challenge lies. A six-figure salary might sound like a lot in other parts of the country, but on Long Island, it can feel surprisingly tight once you subtract the mortgage, property taxes, and everyday costs. The financial pressure is palpable and completely redefines what it means to be financially secure.

When Your Paycheck Meets Housing Costs

For most Long Islanders, the single biggest budget-breaker is housing. For generations, the dream of owning a home has been at the heart of the Long Island lifestyle, but that dream now comes with a jaw-dropping price tag. Home prices and property taxes have consistently climbed faster than wages, creating a massive hurdle for local families.

This is where you hear the term "cost-burdened". It's a simple but powerful concept: a household is considered cost-burdened if it spends more than 30% of its gross income on housing alone. Think about that. When a third or more of your paycheck vanishes before you've even bought groceries or paid for childcare, there isn't much left for anything else.

On Long Island, being cost-burdened isn't some rare exception. It's a widespread reality that affects a huge number of families, perfectly illustrating the intense financial squeeze of our local housing market.

This dynamic creates a growing chasm between what people make and what it costs to simply have a stable place to live. Even families with what would be considered solid, middle-class incomes elsewhere find themselves stretched thin, constantly juggling their budgets to get by in one of the most expensive suburbs in America. For a closer look, our guide on the cost of living on Long Island breaks down these expenses in detail.

The Widening Gap Between Pay and Prices

The numbers paint a pretty stark picture. Despite Long Island’s wealthy reputation, the area has actually seen real median income go down since 2000 when you adjust for inflation. Over that same time, housing costs have shot up by 24%. This disconnect is putting households under an incredible amount of financial strain.

This gap forces people to make tough decisions every day. It's the reason a family earning well over $100,000 can still feel like they're just scraping by.

Here’s how this financial pressure shows up in real life for local families:

Delayed Homeownership: Saving for a down payment feels impossible, pushing the dream of owning a home further and further away.

Limited Discretionary Spending: There’s a lot less money left for the fun stuff, like going out to eat, taking vacations, or pursuing hobbies.

Retirement Savings Strain: How can you save for the future when today’s bills eat up so much of your paycheck? It’s a real challenge for many.

Ultimately, while the high median income is a sign of economic strength, you have to look at it through the lens of the equally high cost of living to understand what’s really going on.

Your Questions About Long Island Income, Answered

Once you start digging into the numbers, the trends, and the high cost of living on Long Island, a lot of practical questions pop up. It’s one thing to see the data, but it’s another to understand what it all means for day-to-day life. Let's tackle some of the most common questions to connect the dots.

We'll get into what a "good" salary really feels like on the Island, which industries are driving those high wages, and how we stack up against other big-name suburbs around New York City.

What Is a Good Salary on Long Island?

This is the million-dollar question, isn't it? Defining a "good" salary here is tough because it's so tangled up with the sky-high cost of living. The median household income is around $137,000 in Nassau and $122,000 in Suffolk, but ask anyone living here, and they'll tell you that "comfortable" often starts much higher, especially if you have a family.

A more useful benchmark is a salary that lets you live without being "cost-burdened," a term housing experts use for spending more than 30% of your income on your home. For most Long Islanders, that means aiming for an income well north of the median. Think closer to the $150,000 to $200,000 range to really handle a mortgage, those infamous property taxes, childcare, and commuting costs, all while trying to put something away for the future.

A six-figure salary that seems enormous elsewhere can feel merely adequate on Long Island. A "good" income isn't just about the number on a paycheck; it's about having enough financial breathing room after the region's steep expenses take their share.

What Are the Highest-Paying Industries?

Long Island’s impressive income figures didn't happen by accident. They’re fueled by a few powerful, high-paying industries that form the core of our local economy. These sectors consistently offer competitive salaries and draw in a highly skilled workforce, which in turn keeps the median income high.

The main engines behind Long Island's high wages are:

Healthcare and Social Assistance: With major hospital networks like Northwell Health and NYU Langone, healthcare is a massive employer. It offers a huge number of high-paying jobs in clinical care, research, and administration.

Finance and Insurance: Being right next door to New York City has its perks. Nassau County, in particular, has a strong financial services sector with everything from banking and investment firms to insurance agencies.

Education: Long Island is known for its well-funded public school districts and respected universities. This creates stable, well-paid careers for teachers, administrators, and professors.

Technology and Aerospace: We have a rich history as a hub for aerospace and defense, and that legacy continues. Today, Long Island is home to advanced manufacturing and tech firms that need specialized, high-earning talent.

These industries work together to create an economic ecosystem that keeps the Long Island median income among the highest in the country.

How Does Long Island Compare to Other Suburbs?

It’s always interesting to see how Long Island measures up against other affluent suburbs near major cities, like Westchester County or parts of Northern New Jersey.

Frankly, Long Island holds its own and often pulls ahead when it comes to household income. While a place like Westchester is certainly wealthy, Long Island’s median income—especially in Nassau County—is consistently one of the absolute highest in the tri-state area. Each region has its own economic flavor; Westchester is arguably tied even more closely to Manhattan's finance world, while New Jersey has a huge pharmaceutical and corporate presence.

What really makes Long Island unique is its blend of high-paying jobs with a distinct coastal and suburban lifestyle that feels less dense than many other NYC suburbs. It’s this combination of financial opportunity and quality of life that makes it such a desirable—and expensive—place to call home.

Stay connected with everything happening in your community. For the latest news, events, and local insights, trust 516 Update to keep you informed. Explore what's new in Nassau County at https://516update.com.